Central America's e-invoicing frontier: A look at pioneering countries

Latin America stands as a global leader in digital tax compliance, with 15 countries already successfully embracing e-invoicing and e-reporting models. While giants like Mexico and Brazil led the initial charge, smaller Central American countries have played a crucial and pioneering role in this movement since its beginnings in Chile in 2003.

As we have previously highlighted, the journey towards digital tax compliance in Latin America began with the pioneering efforts of a select few nations. In our first blog post on the topic, “E-Invoicing and E-Reporting in Latin America: A Global Leader in Digital Tax Compliance”, we examined the initial models developed by early adopters such as Chile, Mexico, and Brazil. Building on this, our second article, “E-invoicing and e-reporting in Colombia and Peru: Following in the footsteps of Latin America’s leaders”, showcased how countries such as Colombia and Peru have advanced these sophisticated systems even further. This article explores the significant contributions of Central American countries to this landscape, showcasing their innovative approaches and pivotal role.

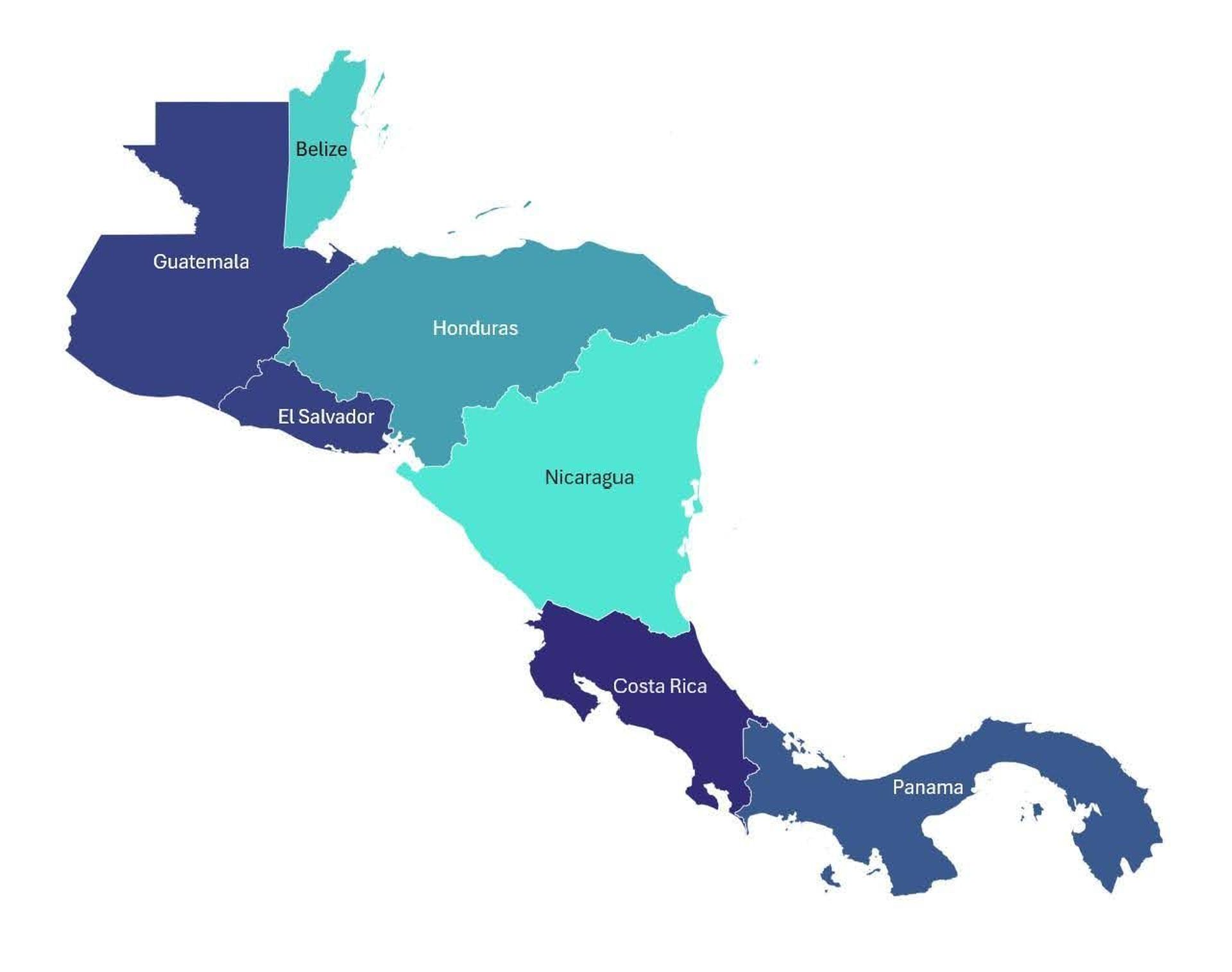

Central American e-invoicing and e-reporting landscape: Which countries have implemented these regulations?

Before delving into the specific models adopted by different Central American nations, it is important to acknowledge a shared vision among their Tax Authorities. Across the region, e-invoicing and e-reporting projects have been embraced and promoted as a great opportunity for their countries, not only to formalise economies and increase tax collection, but also to generate tangible business efficiencies.

Building on this shared vision, and following the diverse approaches seen in other Latin American nations, as discussed in our previous posts, Central American countries like Guatemala, Costa Rica, Panama, and El Salvador have also developed unique and pioneering e-invoicing and e-reporting models. Let’s take a closer look.

Guatemala

The Guatemalan Tax Authority (SAT) initiated its e-invoicing project in 2007. This first version mandated that all e-invoices be issued through an authorised service provider (Generador de Factura Autorizado por la SAT – Certificador Electrónico, or GFACE). By 2018, the model evolved to offer greater flexibility, allowing companies to issue invoices independently, though all e-invoices must still be validated through a certified service provider.

This initiative puts Guatemala not only among the first countries in Latin America to implement e-invoicing and establishes it as a leader in third-party validation models, a system later adopted by larger countries like Mexico and Peru.

Costa Rica

While the official e-invoicing project launched later, non-standardised e-invoicing was already allowed in Costa Rica as early as 2009. During this time, some companies adopted these early digital invoicing practices to gain operational benefits, such as digitally signing XML documents, aligning with best practices already implemented in several other Latin American countries.

Officially, however, Costa Rica launched its formal e-invoicing project in 2017 with a pilot implemented by the Treasury Department (MH), which subsequently became mandatory for all businesses. This 2017 initiative established a standardised system.

A key feature of the Costa Rica model is its well-regulated commercial validation of e-invoices, allowing buyers to accept or reject digitally signed standardised messages received from suppliers, which must also be filed with the tax authority.

Panama

The e-invoicing project was initiated by the Tax Authority (DGI) in 2016. Following its launch, a voluntary implementation phase began in 2021, leading to a gradual mandatory rollout by business sectors since 2022.

A core feature of the Panamanian model is that the validation of all e-invoices is carried out by certified service providers (PACs). Additionally, the commercial validation of e-invoices is regulated within the system.

El Salvador

El Salvador initiated its e-invoicing journey more recently with a pilot project in 2018, regulated by its Treasury Department (MH). Building on this, a mandatory gradual rollout by business sectors has been underway since 2023.

A notable distinction of the Salvadoran model is its use of a standardised JSON structure for the digital representation of e-invoices, unlike most other Latin American regulations, which predominantly utilise XML formats. This choice reflects a modern approach to data exchange, potentially offering benefits in terms of flexibility and integration for businesses

Conclusion

Following the tendency established in Latin America by leaders like Chile, Mexico, Brazil, and successfully replicated by countries such as Colombia and Peru, Central American e-invoicing models similarly embrace the standard formats for digital documents (predominantly XML). These regulations, set out by each country’s Tax Authority, mandate that documents be digitally signed and submitted in real time for validation through official technological platforms or certified service providers.

Beyond mere compliance, the regulation of commercial validation in some of these countries not only facilitates seamless digital exchange between companies, but also lays the groundwork for innovative financial models. These models, posed to support small and medium-sized businesses (SMEs), leverage invoice financing and payment through dynamic discounting and e-factoring services, mirroring approaches seen in countries like Colombia and Peru.

Undoubtedly, Central American e-invoicing and e-reporting models represent very important examples, as we mentioned in previous articles while describing similar projects in other Latin American countries, of how compliance can transcend fulfilling obligations. They act as a powerful catalyst for business efficiency, innovation, and competitiveness, driving digital transformation to foster both regulatory compliance and economic growth.

At Banqup Group (formerly Unifiedpost Group), we observe how these positive examples are being replicated all over the world, bringing many benefits while also introducing complexities and challenges. To assist businesses in navigating this evolving landscape, we offer a variety of powerful tools designed to simplify real-time validations, secure document transmission, and seamless integration with tax authorities and other entities. By leveraging Banqup’s solutions and experience, companies can gain a clearer and more timely understanding of global e-invoicing and e-reporting compliance requirements, streamline their processes, mitigate fraud risks, and unlock opportunities for greater operational efficiency and financial services.