Compliance and Regulations

Slovakia’s path to e-invoicing: B2G, B2B, and what’s next?

This article was last updated on 15 December 2025 to reflect the full approval of the VAT Act amendments by the National Council on 9 December 2025.

As digital transformation sweeps across Europe, Slovakia embraces e-invoicing and e-reporting as powerful tools to modernise its tax and administrative frameworks. With new obligations on the horizon and lessons learned from past initiatives, this article explores Slovakia’s journey so far and its plans for the future, particularly in light of the recently proposed amendments to the VAT Act.

B2G & G2G e-invoicing: An important milestone reached

Slovakia introduced mandatory e-invoicing for Business-to-Government (B2G) and Government-to-Government (G2G) transactions through a phased rollout, starting in April 2023. Public entities, including the Ministry of Finance and other government institutions, were the first to adopt the system, which requires businesses providing goods and services to public entities to issue invoices electronically. This move aligned Slovakia with EU goals for greater transparency and efficiency in public procurement.

The e-invoicing platform used for B2G transactions, known as the IS EFA (Informačný Systém Elektronickej Fakturácie), ensures compliance with the European standard for electronic invoicing (EN 16931). Businesses that do business with public authorities must issue invoices that comply with this structured data standard to facilitate automated processing and reduce manual intervention.

B2B e-invoicing: A history of anticipation

While B2G and G2G e-invoicing are fully operational today, Slovakia’s journey towards Business-to-Business (B2B) e-invoicing has been marked by delays and shifting timelines. Initial plans for a voluntary B2B e-invoicing system began in January 2022, with mandatory obligations expected shortly thereafter. However, as of early 2024, the mandates were indefinitely postponed, and the rollout for B2B e-invoicing remained undefined.

This changing landscape reflects both the complexity of implementing a comprehensive e-invoicing framework and Slovakia’s cautious approach to integrating businesses into the system. The delays have not deterred progress but have underscored the need for a robust legal and technical foundation.

A more recent update on this topic, detailing the official legislative amendments and the 2027 mandate, can be found in our blog post “Slovakia's next step: A 5-corner model for e-invoicing in 2027”.

The Law: A clearer vision for the future

On 9 December 2025, the Slovak Republic’s National Council (NR SR) officially approved amendments to Act No. 222/2004 on Value Added Tax (the VAT Act). This newly approved law aligns with the EU’s ViDA (VAT in the Digital Age) initiative and proposes mandatory electronic invoicing and online reporting for domestic VAT-registered taxpayers starting 1 January 2027. Aiming to curb tax evasion, real-time electronic invoice data reporting to the financial administration will also be required from this date. The mandate will extend to cross-border supplies from 1 July 2030, in line with the ViDA timelines. The law is now in the final editorial stage before being submitted to the President of the Slovak Republic for signature and subsequent publication in the Official Collection of Laws (Zbierka zákonov).

Let’s unpack the key aspects of the amendment:

E-Invoicing

Starting from 1 January 2027, all VAT-registered taxpayers will be required to issue and receive invoices in a structured electronic format. Only invoices that comply with EN 16931 will be considered valid, ensuring standardisation and interoperability between businesses.

As defined in the amendment, an e-invoice must be created, sent, and received in a format that allows for full automation and digital processing, eliminating manual handling.

This obligation will initially apply to domestic transactions and mirror the requirements for cross-border transactions outlined in the ViDA initiative.

Additionally, for foreign taxpayers regarding cross-border transactions, mandatory electronic invoicing and online reporting will begin by 1 July 2030. Cross-border electronic invoice data reporting will also be required from this date.

E-Reporting

Also from January 2027, businesses will be required to report data from issued and received invoices to the Slovak Tax Administration in real time (known as real-time reporting). This requirement extends to foreign taxpayers for cross-border transactions starting 1 July 2030. This will align domestic processes with EU-wide digital reporting requirements (DRR), which will be introduced with ViDA effective 1 July 2030.

The system aims to combat tax fraud, reduce VAT gaps, and modernise tax administration. By receiving data in real time, the tax administration can proactively detect irregularities and improve compliance.

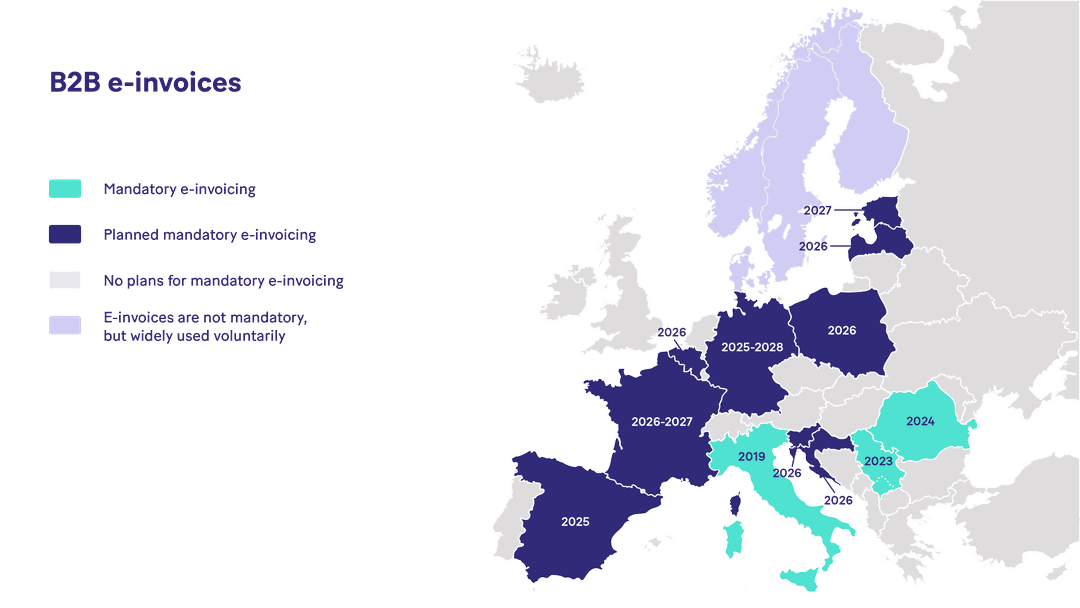

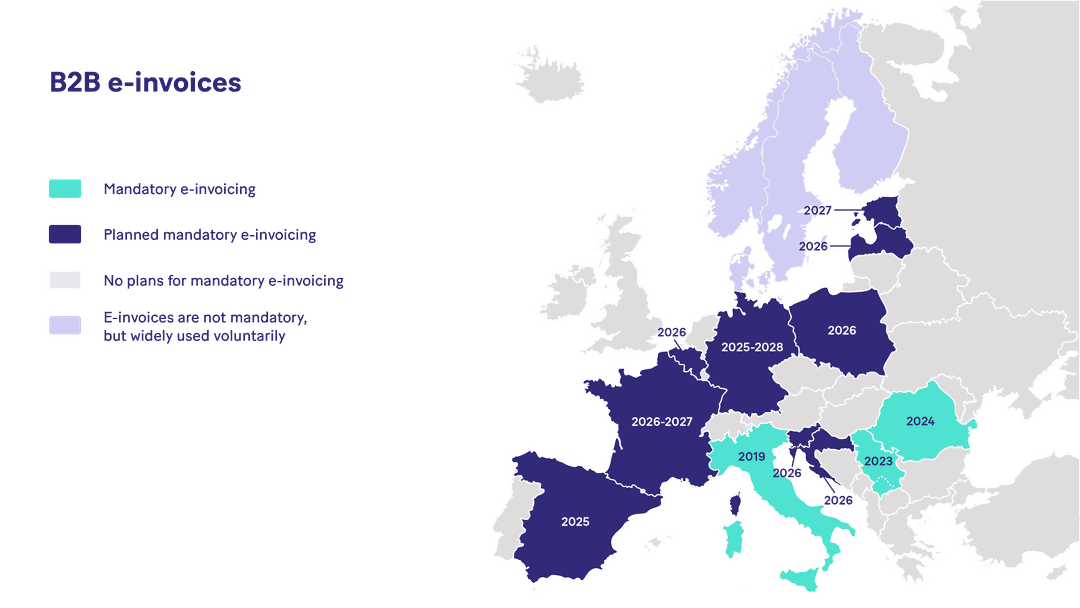

Slovakia’s initiative in the wider European context of ViDA

Slovakia’s move towards e-invoicing and e-reporting reflects broader European efforts to digitise VAT compliance. The ViDA initiative, adopted by the Council of the European Union in March 2025, will mandate electronic invoicing and real-time data exchange for cross-border transactions within the EU. Slovakia’s draft law not only aligns with these goals but also prepares businesses for the eventual transition to a fully harmonised EU-wide system.

With real-time reporting and structured e-invoicing, businesses will benefit from faster processing, reduced administrative burden, and improved tax compliance. However, the shift also requires significant preparation, including system updates and process changes to meet the new requirements.

Looking ahead: What’s next for Slovakia?

With the final legislative hurdle cleared, Slovakia’s e-invoicing framework will bring major changes over the next three years:

B2B e-invoicing mandate from 2027: The structured e-invoicing requirement will apply to all domestic transactions, creating a single, uniform standard for businesses of all sizes.

Evolution of e-reporting: Real-time reporting will become mandatory, enabling the tax administration to detect and prevent fraud more effectively.

Alignment with ViDA: By adopting these measures, Slovakia will position itself as a proactive participant in the EU’s digital transformation of VAT compliance.

The Ministry of Finance actively sought public involvement in developing this transformative law. During the consultation period, which ended on 19 August 2025, citizens and stakeholders were invited to submit comments and suggestions on the draft law. This demonstrated the Ministry's eagerness to incorporate public feedback. These insights were instrumental in shaping the final approved text of the law.

While challenges remain, including ensuring business readiness and updating government systems, the benefits of this digital transformation are clear. Slovakia’s commitment to e-invoicing and e-reporting will not only increase transparency but also strengthen the country’s tax system and business environment.

For the latest and most detailed information on the B2B e-invoicing mandate, including the anticipated “5-corner model”, please see our follow-up article “Slovakia's next step: A 5-corner model for e-invoicing in 2027”.

Preparing for the change

For businesses in Slovakia, now is the time to evaluate your invoicing systems. Whether you’re already using e-invoicing for B2G transactions or preparing for the upcoming B2B mandate, compliance is key. Explore solutions that support EN 16931 standards, enable real-time reporting, and ensure a seamless transition to the digital future.

Stay tuned for further updates as Slovakia develops its e-invoicing framework and prepares to join the EU’s harmonised VAT system under ViDA.