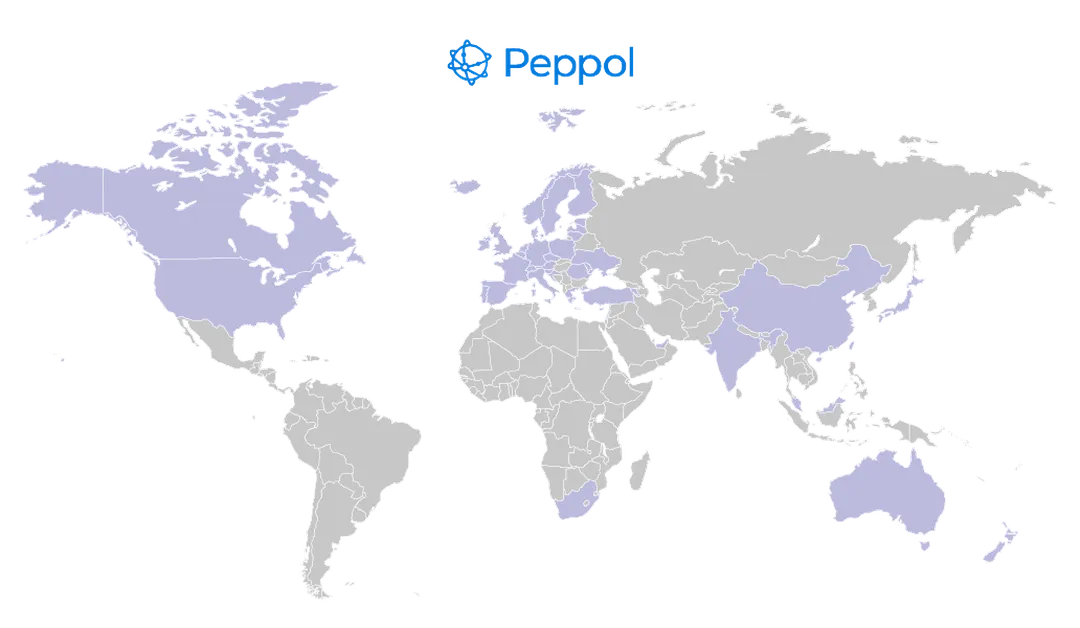

Explore the latest electronic invoicing, reporting and archival requirements.

France

Regulations

E-invoicing requirements in France

Banqup Group has a compliant inbound and outbound solution. Our solution for France is officially PA-certified.

Technical requirements

Platform

* B2B: Mandatory exchange via a certified "Plateforme Agréée" (PA).

* B2G: Continued use of the Chorus Pro infrastructure (integrated with the PPF).

* "Portail Public de Facturation" (PPF) Role: Functions as the National Directory and central data concentrator for tax reporting.Format - B2G / B2B - Factur-X, UBL 2.1 and CII

Archival period - Minimum 10 years

B2G mandates

Receiving - All public bodies

Issuing - All public bodies and their suppliers

B2B mandate deadlines

2025 - Voluntary pilot period for all companies

September 2026 - All businesses to receive e-invoices and large and mid-sized companies to issue e-invoices and comply with e-reporting

September 2027 - SMEs and micro-companies fall into scopr

B2B mandate overview

B2B e-invoices to be transmitted via accredited service providers (PA)

B2C and cross-border B2B invoice data, as well as certain payment data to be submitted under an e-reporting obligation