The e-invoicing maze: Navigating global compliance models

The global electronic invoicing (e-invoicing) market is in a constant state of flux, driven by the universal goal of reducing the national VAT gap. As governments increasingly mandate digital invoicing, a diverse and often complex range of models has emerged. For companies operating internationally, keeping up with these varied requirements in multiple countries is a significant challenge.

The evolving complexity of compliance

The indirect tax reporting landscape is growing in complexity, with a myriad of models and reporting frequencies. Businesses must contend with clearance, real-time, daily, monthly, bi-monthly, quarterly, annually, and on-demand reporting, with requirements often differing for suppliers and buyers.

A key distinction lies between e-invoicing and e-reporting. In e-reporting, it's not the invoice itself that requires government approval, but a report or document containing the invoice information, often reported in real-time.

The rise of Continuous Transaction Control (CTC) is fundamentally transforming the way tax reporting is conducted. The shift towards real-time reporting emphasises the importance of speed and accuracy. Furthermore, the scope is expanding to include various documents, including orders, dispatch advice and payments. This shift is underscored by the evolution of connectivity — from point-to-point and EDI to networks — and the ability to connect with all trading partners via a single connection.

Benefits of e-invoicing automation

Amidst this complexity, e-invoicing automation offers a number of significant benefits. Chief among these are:

Standardisation of data: This ensures consistent data entry and exit from customer systems, simplifying the process of reaching targeted endpoints, particularly when adhering to standards like the European Norm (EN 16931 e-invoicing standard).

Simplification of reporting: Accurate information is readily available in the ERP system, making reporting more efficient.

Scalability: Business processes are simplified through standardisation, allowing for greater scalability.

A look at diverse e-invoicing models

To fully grasp the level of complexity that international businesses have to deal with in the global business landscape, it is important to recognise the wide range of "flavours" in use around the world.

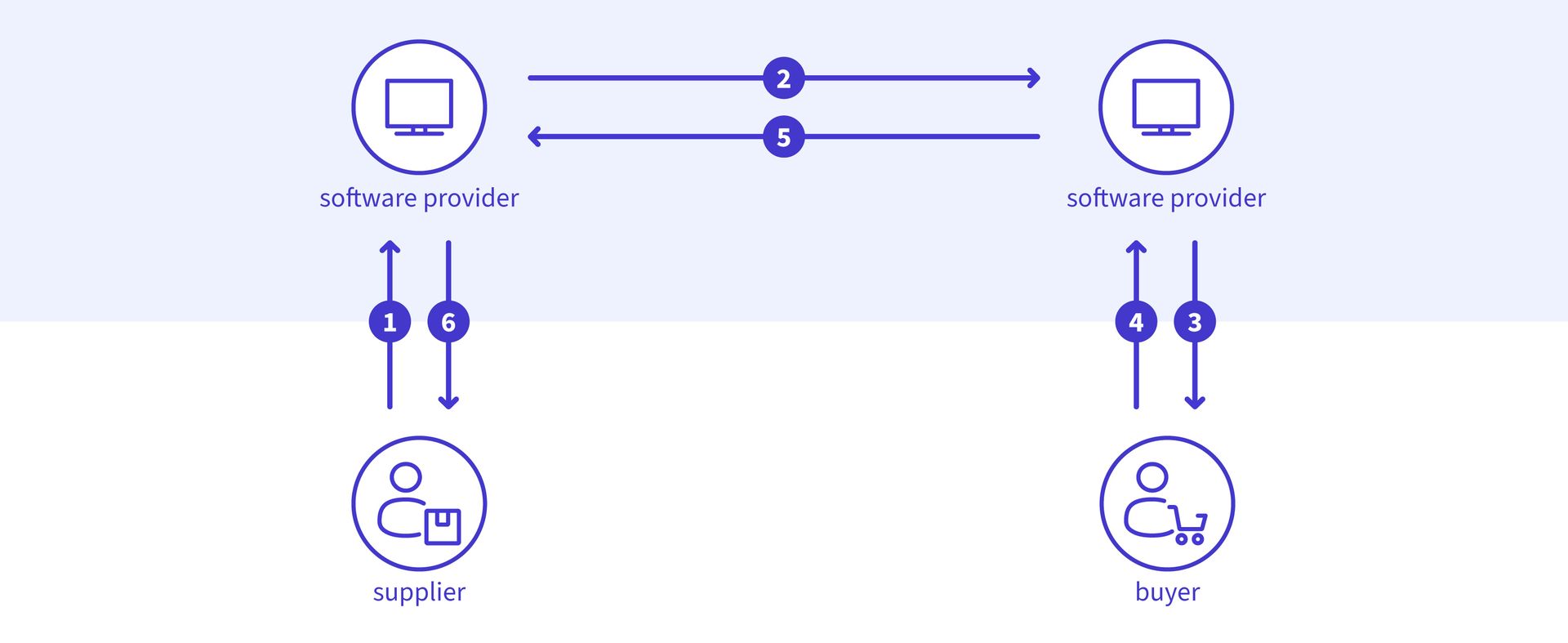

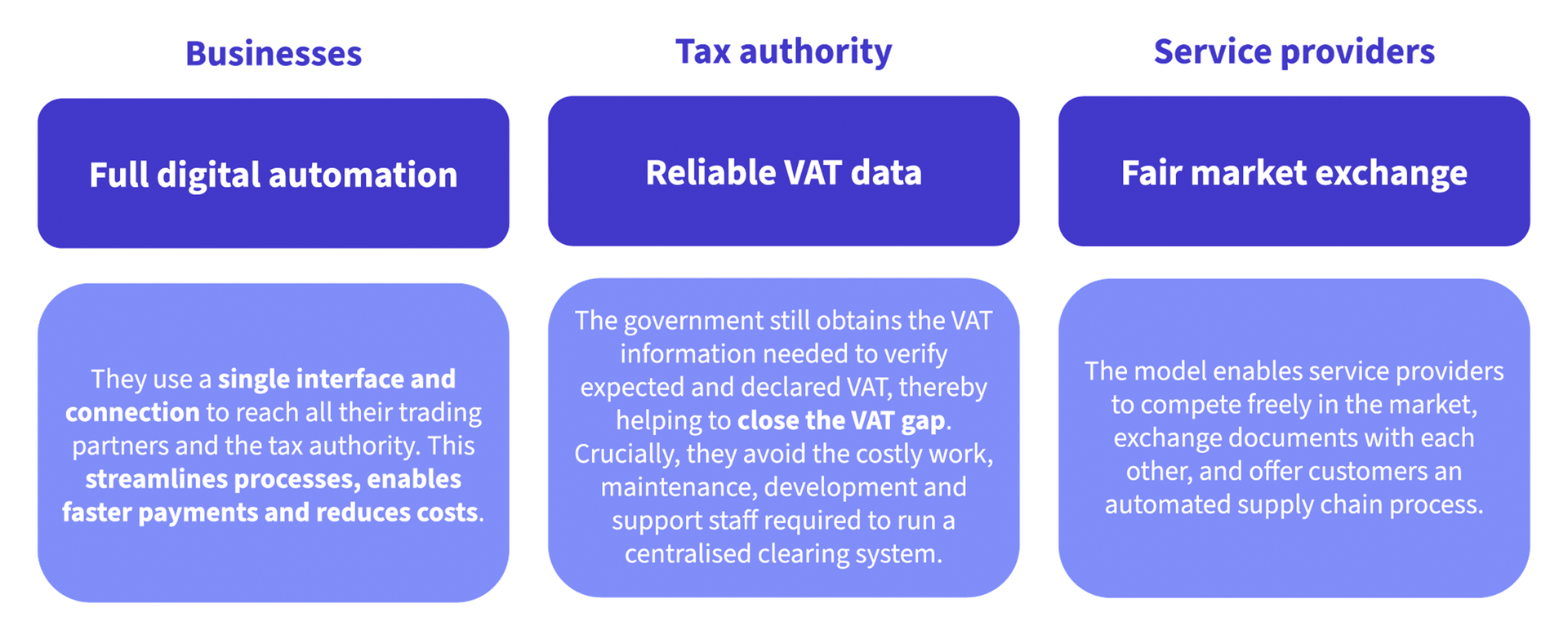

Interoperability models (e.g. Peppol and the GENA 4-Corner model): These models facilitate the decentralised exchange of information between trading partners via a network of certified service providers, with no associated real-time reporting to the authorities. Many businesses adopt these models due to mandates and the significant business benefits they offer, such as increased automation and efficiency in supply chain document processes. Real-life examples of mandates include Business-to-Government (B2G) e-invoicing across Europe, applicable to contractors and subcontractors providing goods and services to public entities.

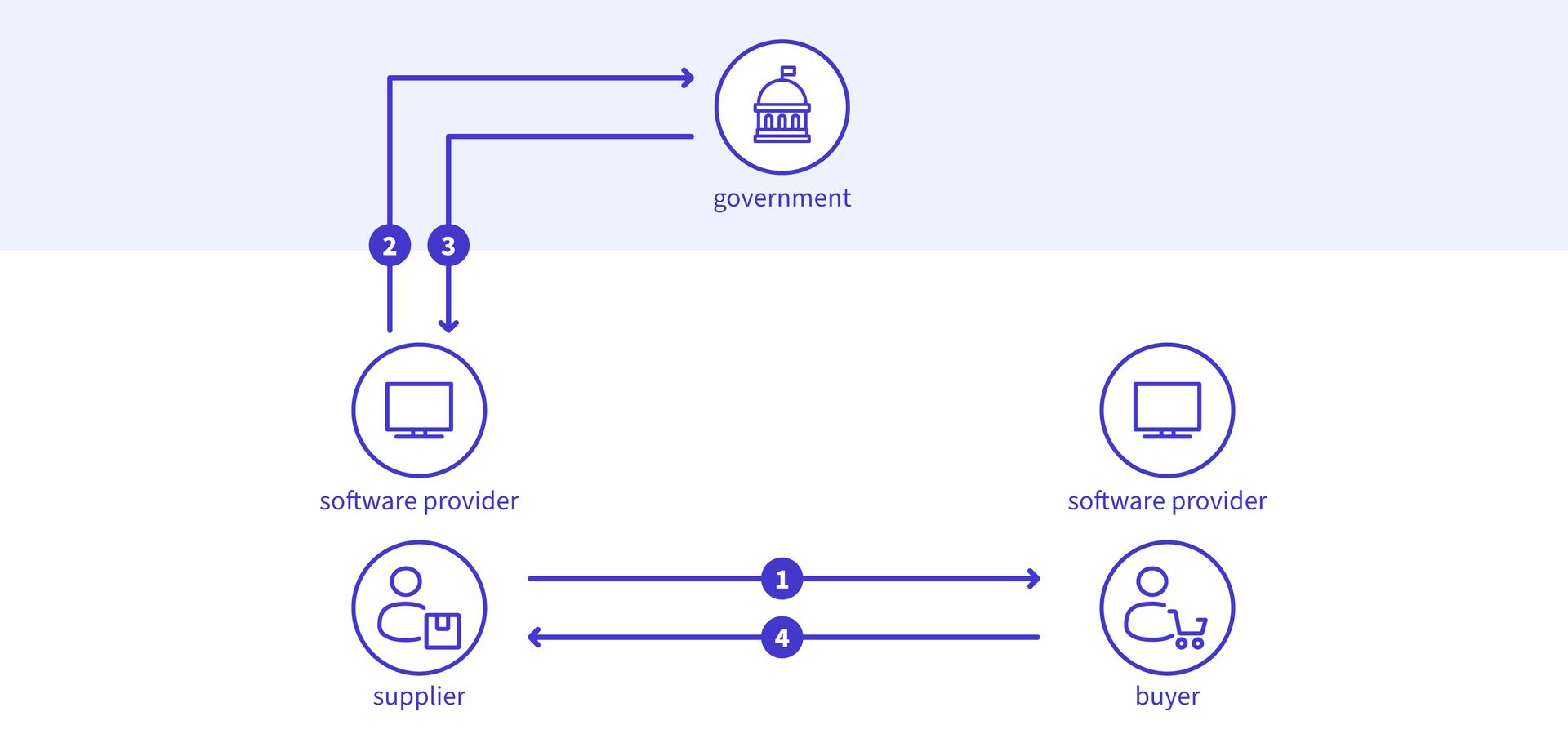

Real-time reporting (RTR) models: These models require businesses to submit transactional data to the tax authorities. However, the authorities generally do not mandate or concern themselves with the electronic exchange of invoices between trading partners. This often results in an additional, cumbersome two-step process for taxpayers, who remain responsible for ensuring that invoices are exchanged (for example, by sending them to customers). Key examples include Hungary (NAV) and Spain (SII, and starting from January 2027, VERI*FACTU).

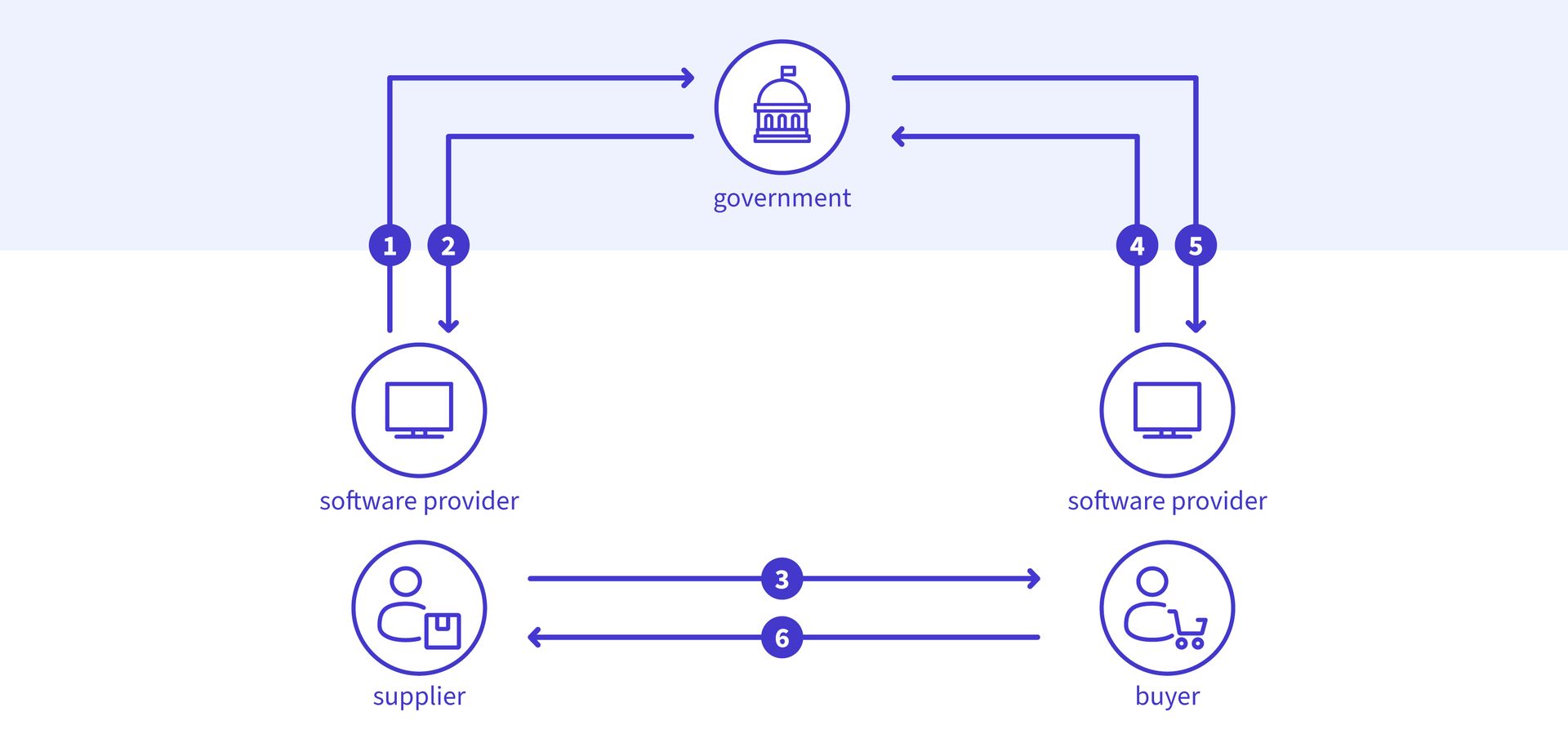

Continuous Transaction Control (CTC) – clearance models: These models involve the tax authority validating invoices before or after they are submitted to the customer, often via a designated system with a specific format. This can occur with or without the end customer communicating receipt of the invoice or its status. Although this creates a two-step process, it is generally less cumbersome than RTR models as it involves processing the same invoice data rather than adding an extra reporting step. These regulations come in different forms, including centralised and decentralised approaches.

Centralised exchange models: In this CTC approach, the tax authority validates and approves invoices directly through a government-designated system that is also used for invoice exchange between trading parties. Italy's SDI and Poland's KSeF are prime examples of this. In these models, the tax authority is directly involved in business transactions, often validating and approving invoices before they are delivered to end customers. While this is effective for closing the VAT gap, it can force businesses to create an additional process solely for tax compliance, adding extra work.

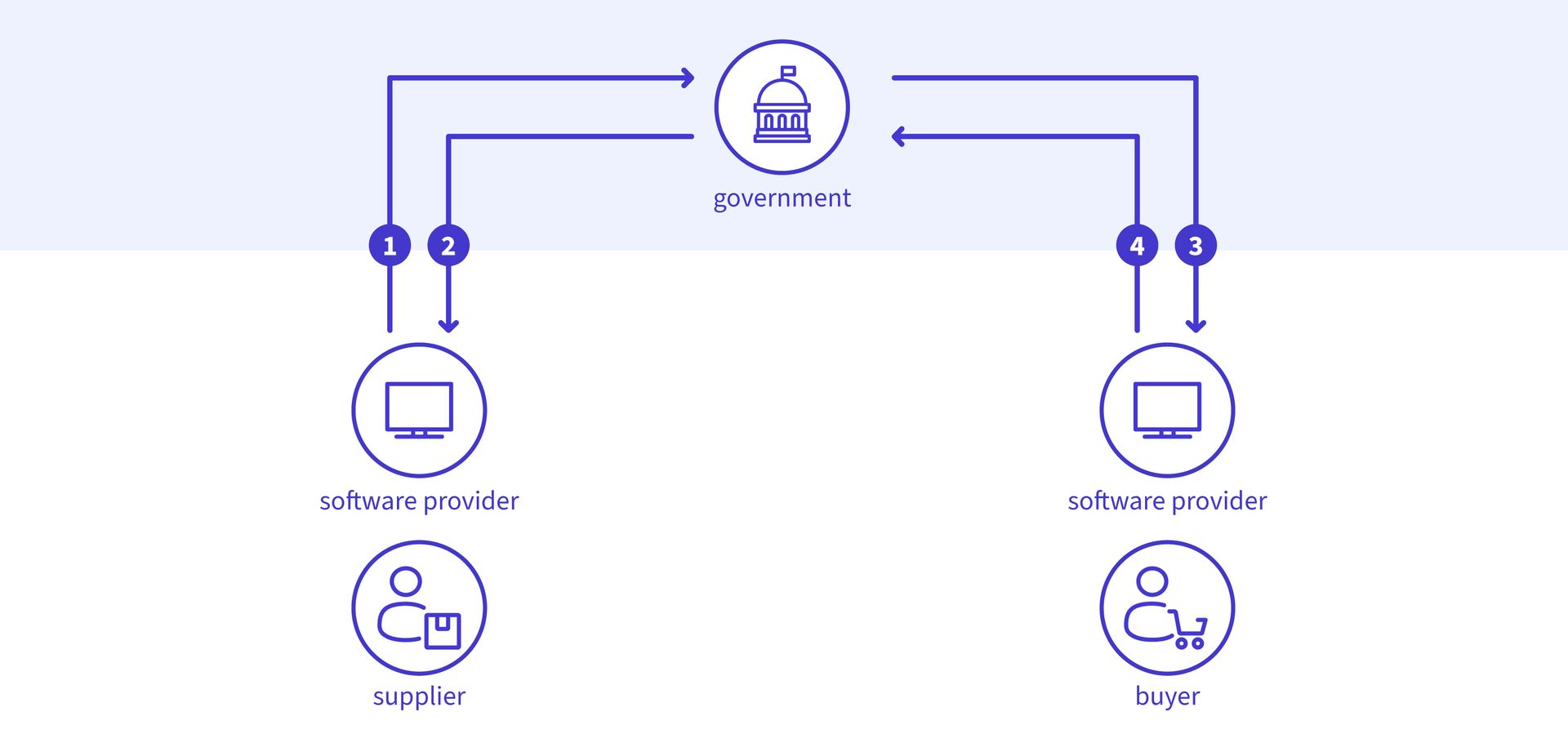

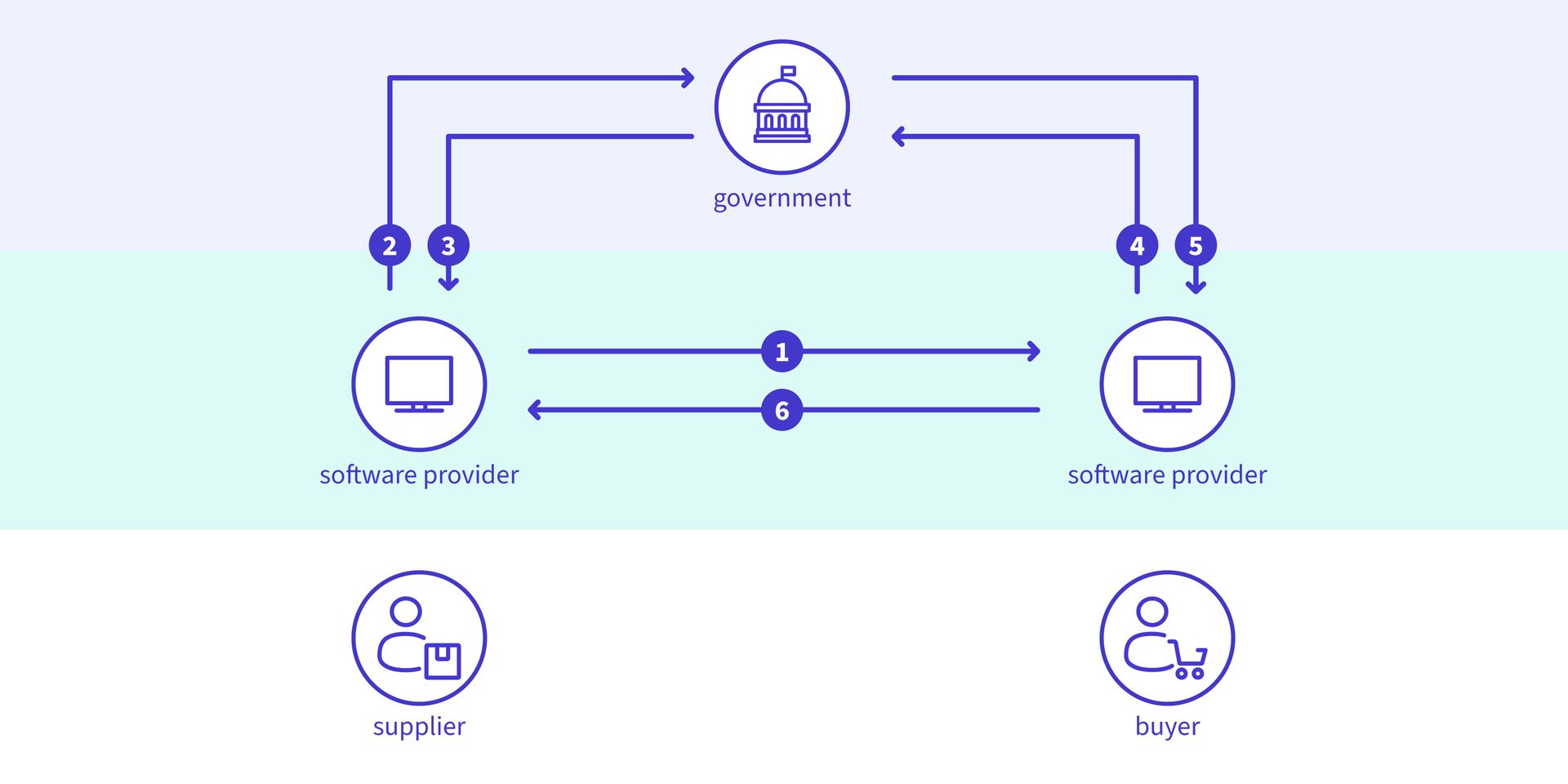

The Decentralised CTC and Exchange (DCTCE) model (also known as the 5-Corner model): This evolving solution is endorsed by global e-invoicing stakeholders such as Peppol and GENA. It aims to align the commercial interests of businesses (automation and efficiency) with the fiscal interests of governments (compliance and fraud prevention) by combining the business efficiencies of a decentralised exchange with the real-time data requirements of the tax authority. In this model, suppliers and buyers each choose their own certified service provider (e.g. a Peppol Access Point, such as Banqup Group). Documents are sent electronically in structured formats between these providers, thereby automating the entire supply chain document process. The tax authority connects to the service provider to extract relevant VAT information in real or near-real time without running a central platform or blocking the invoice flow.

Taking a closer look at the evolving solution – the DCTCE model

The Decentralised CTC and Exchange Model started to emerge because many of the traditional compliance models, while successful for tax administrations, failed to deliver on the most important promise for the private sector: full business automation. Created and endorsed by global e-invoicing stakeholders, as mentioned above, this model combines the business efficiencies of decentralised exchange with the real-time data needs of the tax authority.

The DCTCE model transforms the compliance burden into an automated supply chain process:

Business chooses provider: The supplier and buyer each choose their own certified service provider (often a Peppol Access Point). These providers exist within a decentralised network and are certified by the tax authority.

Automation & exchange: The documents are sent electronically via structured formats (like Peppol BIS) between the trading partners' service providers. The businesses use their chosen provider to automate their full supply chain document process (not just the invoice).

Tax authority extracts: The tax authority does not run a central platform or block the invoice flow. Instead, it "sits on top" with a connection to the service provider (the 5th corner) to extract the relevant VAT information in real-time or near-real-time.

The DCTCE benefits for all stakeholders

The DCTCE model is considered the "dream model" because it finally aligns the commercial interest of businesses (automation and efficiency) with the fiscal interest of governments (compliance and fraud prevention).

Conclusion: A global shift is underway

The e-invoicing landscape is in a “tornado” phase of mass adoption and transformation. Although successful centralised models exist, the trend, particularly in Europe under the ViDA initiative, is moving towards more flexible, business-friendly decentralised models. The creators of the Decentralised CTC and Exchange (5-Corner) model are optimistic that many countries yet to establish mandates will opt for this simplified, efficient approach. Increased adoption of a unified model will undoubtedly lead to a simpler, more positive global process for everyone involved.

To stay fully informed on the technical specifications and legislative adoption of the DCTCE model and other emerging mandates, you can follow us on LinkedIn for more timely updates.

Danielle Kiener

Lead Key Account Manager, Banqup Group

Danielle has 15 years of experience in customer relationship management within invoicing and financial administration. She currently works in Geneva, supporting global customers at Banqup Group and helping multinational companies digitise their processes. Over the years, she has been closely involved in the digital transformation of invoicing, including leading e-invoicing initiatives across the EMEA and Asia-Pacific regions for a major multinational. Her extensive experience means she’s always up to date on the latest e-invoicing regulations and changes around the world.