Finland shows another way: How e-invoicing scaled without a mandate

Summary

Finland’s e-invoicing success is built on a long-term, market-driven transition rather than sudden, heavy mandates.

A four-corner network model, supported by banks and service providers, enabled early and widespread adoption, especially among SMEs.

Adoption is high: Over 90% for Business-to-Government (B2G), and 70-80% for Business-to-Business (B2B) by 2025. This success is the result of targeted B2G mandates combined with a powerful market-driven pull in the B2B sector.

Finland is now advancing toward a broader “Real-Time Economy” (RTE) vision, using e-invoicing as a foundation for fully digital business processes.

Finland is often cited as one of Europe’s most mature and market-driven success stories in electronic invoicing. Rather than relying on sudden mandates or centralized platforms, the country has built a mature, interoperable e-invoicing ecosystem over time. This article explores why e-invoicing works so well in Finland, what makes its approach different, and why it is increasingly used as a reference point for other countries navigating their own digital invoicing transitions.

A long-term transition, not a sudden mandate

Finland’s success with e-invoicing is the result of a long, deliberate process. The foundations were laid more than 20 years ago, when Finland pioneered direct bilateral e-invoicing, which minimizes intermediaries, and, in 2005, launched one of the world’s first national implementations of the Peppol network. Through close collaboration among public authorities, private companies, banks, and technology providers, stakeholders focused early on standardization, interoperability, and practical usability, rather than waiting for strict legal obligations.

This collaborative approach allowed businesses to adapt gradually, build trust in digital processes, and invest in automation at their own pace. As a result, e-invoicing became an integral part of day-to-day operations long before it was framed as a regulatory requirement.

The four-corner network model: flexibility by design

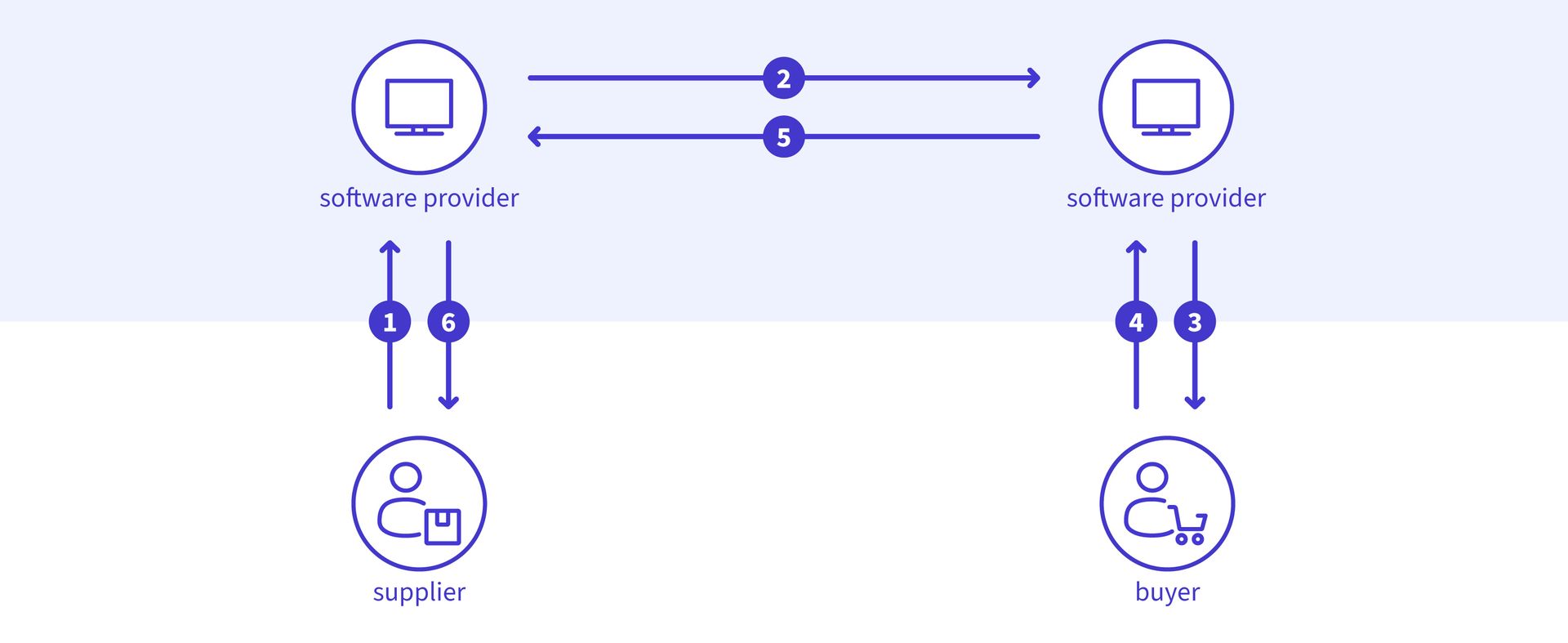

Unlike some other countries that rely on a single, central government platform, Finland operates a four-corner e-invoicing model. In this setup, senders and receivers connect to the network via their chosen service providers, such as banks or e-invoicing operators. These providers then securely route invoices between parties.

This model strikes a critical balance between flexibility and standardization. Businesses retain the freedom to choose their providers, while structured formats and shared rules ensure interoperability across the entire network. The result is a market-driven ecosystem that scales efficiently without fragmenting.

This model contrasts sharply with those of many other EU countries, which are implementing mandatory, centralized platforms, like KSeF in Poland, or requiring the use of specific, fee-based intermediaries, like the “Plateformes Agrées” (PAs) in France. Finland’s approach allows for a highly competitive market with minimal mandatory intermediaries, which keeps exchange costs low and encourages direct connection.

The role of banks as early adoption drivers

A distinctive feature of Finland’s e-invoicing landscape is the central role played by banks. Unlike in many other countries, where adoption was primarily led by specialized IT providers, Finnish banks were among the earliest promoters of structured e-invoicing.

Even today, many SMEs in Finland send and receive e-invoices directly through their online banking interfaces. Embedding e-invoicing into familiar banking tools significantly lowered the barrier to entry, accelerating adoption across the business community and ensuring that digital invoicing was accessible well beyond large enterprises.

Standards that support interoperability and compliance

Finland’s ecosystem blends national and European standards pragmatically. Historically, Finvoice and TEAPPSXML, two distinct UBL‑based formats that serve as Finland’s national CIUS (Core Invoice Usage Specifications) for EN 16931, enabled early domestic automation and interoperability while ensuring compliance with the European standard. Finland also supports Peppol BIS Billing 3.0 for seamless cross-border exchange via the Peppol network.

E-invoicing has been mandatory for Business-to-Government (B2G) transactions since 2010, initially using pre-EN 16931 versions of these national standards. Starting April 1, 2019, central government bodies were required to receive and process EN 16931-compliant e-invoices (Finvoice 3.0, TEAPPSXML 3.0, UBL 2.1, CII, or Peppol BIS 3.0) under the eInvoicing Act 241/2019, which expanded the scope to include national procurement thresholds.

In the B2B space, e-invoicing adoption in Finland remains voluntary but highly effective, reaching an estimated 70–80% penetration. Under the eInvoicing Act, businesses with a turnover above €10,000 have the right to request EN-compliant e-invoices and reject paper or PDF formats. Rather than mandates, market forces have driven this success, with large buyers such as Nokia and KONE leading adoption by requiring e-invoices to benefit from lower processing costs, fewer errors, and faster payment cycles.

This dual approach has allowed Finland to remain compliant with European regulations while preserving continuity for businesses that invested early in national formats.

High adoption without aggressive mandates

One of the most striking aspects of Finland’s experience is the high level of adoption achieved without aggressive mandates. Currently, B2G adoption exceeds 90%, and B2B penetration is estimated to have reached 70–80% by 2025. Although legal requirements established a baseline for public procurement, as detailed above, the widespread B2B adoption primarily emerged through economic and operational incentives driven by market pull. This approach contrasts with the regulatory push seen in countries like Poland, France, and Germany, where mandatory B2B rollouts are backed by heavy fines.

Today, the vast majority of invoices exchanged in Finland are electronic and structured. This shows that, with reliable infrastructure, clear standards, and accessible tools, businesses will adopt digital processes even without universal mandates.

From e-invoicing to the “Real-Time Economy”(RTE)

Building on its strong foundation in e-invoicing, Finland is now advancing toward a broader vision known as the “Real-Time Economy (RTE)”. This initiative aims to digitalize and automate not only invoices, but also receipts, waybills, and other core business documents by default.

The goal is to enable near real-time financial reporting, improved transparency, and more efficient data flows across the entire business lifecycle. In this context, e-invoicing is a cornerstone, not an end state, for a more automated, data-driven, and interconnected economy.

Through the Real-Time Economy (RTE) program (2019–2024, now continuing), the Finnish government is coordinating this transition, targeting 2030 for a fully digital ecosystem. In this ecosystem, services will communicate automatically via shared standards (e.g., eKuitti for receipts and Finvoice, TEAPPSXML, and Peppol for invoices). Financial data will flow in real time between companies, banks, and authorities. Reporting obligations will shrink as structured business data feeds tax authorities and Statistics Finland directly.

E‑invoicing was the foundation. Now, the RTE program positions Finland as a pioneer in Europe's digital economy, where businesses save time, authorities gain real-time compliance insights (estimated €150–200 million in annual savings on tax administration), and data becomes a competitive asset.

What other countries can learn from Finland

Finland’s experience offers several lessons for countries still navigating their own e-invoicing transitions:

Start early and think long term: Sustainable adoption is built over years through collaboration, not rushed mandates.

Balance regulation with market incentives: Targeted B2G mandates can coexist with voluntary B2B adoption driven by efficiency gains.

Prioritize interoperability: Supporting both national and European standards ensures domestic efficiency while enabling cross-border trade.

Leverage trusted intermediaries: Banks and established service providers can play a decisive role in accelerating SME adoption.

Provide accessible public support: Resources like the free Suomi.fi portal, which provides businesses of all sizes with access to e-invoicing services (Finvoice/TEAPPSXML/Peppol), are vital for accelerating SME adoption.

Finland as a blueprint

Finland’s model cannot be copied exactly by every country. Legal frameworks, market structures, and levels of digital maturity differ across Europe. However, Finland clearly demonstrates that e-invoicing success does not require rigid central platforms or immediate universal mandates.

Instead, a hybrid approach combining collaboration, standardization, trusted intermediaries, and a clear long-term vision can deliver high adoption, strong compliance, and readiness for future digital initiatives. For countries looking to modernize their invoicing landscapes, Finland is a compelling and practical example.

Building a future-proof e-invoicing strategy

Finland’s e-invoicing journey demonstrates that sustainable digital transformation is as much about ecosystem design as it is about regulation. By prioritizing interoperability, engaging trusted partners such as banks, and allowing businesses to adopt structured invoicing at their own pace, Finland has achieved widespread adoption without imposing excessive regulations.

As more countries introduce or expand e-invoicing mandates, Finland’s experience offers valuable insights: establish solid foundations first, align incentives with genuine business value, and view e-invoicing as a catalyst for broader digital and economic transformation rather than a standalone obligation.

To ensure your business is prepared for evolving mandates worldwide, from new technical standards to phased rollouts, be sure to follow us on LinkedIn.

Felipe Jhones Dos Santos

Marketer, Banqup Group

Felipe is a marketing professional specialised in Marketing and International Business and is currently based in Madrid. Most of his professional experience has been developed in B2B and SaaS environments, particularly within the financial and technology sectors. He has worked on initiatives ranging from campaign development and brand positioning to customer journey optimisation and the alignment between marketing and commercial teams. His approach is focused on clarity, consistency, and creating impact through well-structured execution.