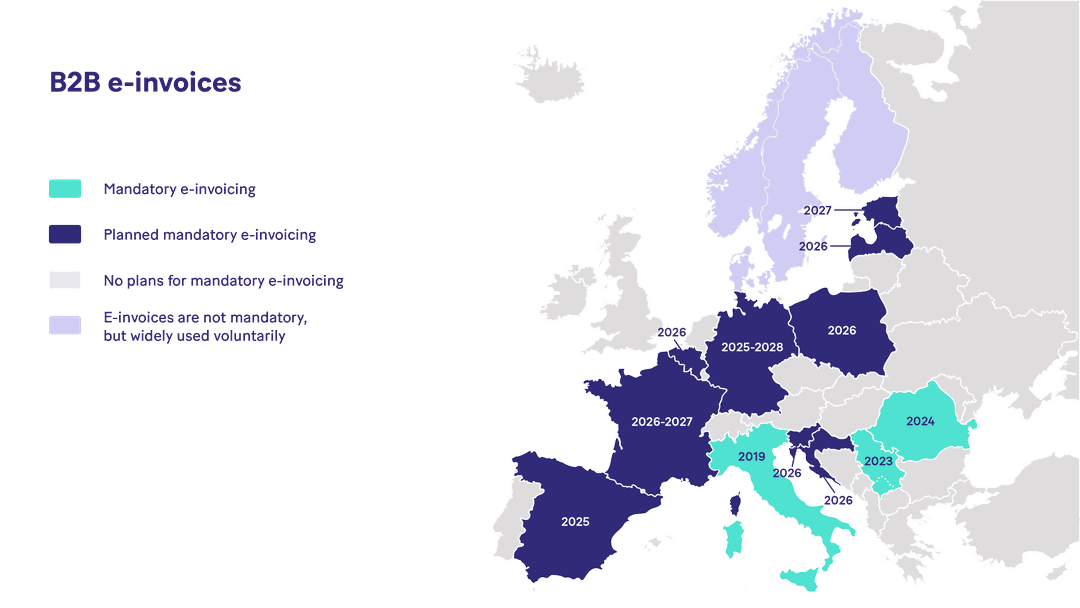

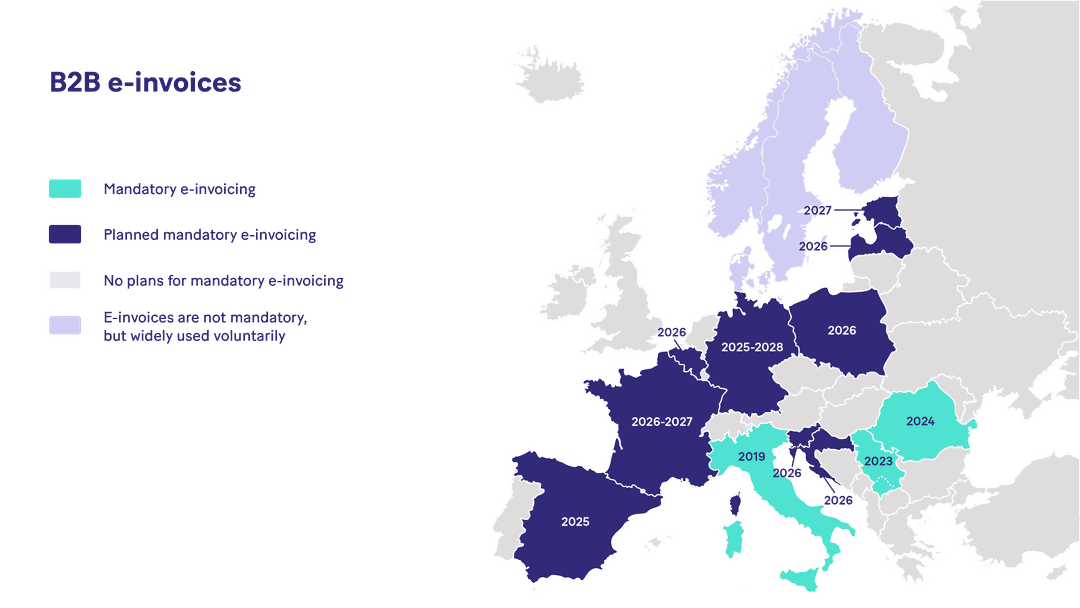

La Belgique a annoncé l'obligation de facturation électronique.

Le 2 février 2024, le Parlement belge a approuvé une modification législative du Code de la TVA, ouvrant la voie à la facturation électronique obligatoire pour les transactions entre entreprises (B2B) d'ici 2026.

Cette initiative s'inscrit dans le cadre de l'engagement plus large du gouvernement à tirer parti des avantages de la facturation électronique et à rationaliser les processus administratifs.

Le pays a déjà entrepris les démarches nécessaires pour demander une dérogation à la Commission européenne, afin d'être autorisé à déroger aux dispositions de la directive TVA 2006/112/CE et d'introduire la facturation électronique obligatoire pour les contribuables nationaux.

Portée de l'obligation

À partir du 1er janvier 2026, les entreprises assujetties à la TVA avec une immatriculation à la TVA et une implantation en Belgique sont obligées de recevoir et d'envoyer des factures électroniques structurées, sans possibilité de les refuser.

Même si une entreprise n'est pas tenue d'émettre des factures selon la réglementation nationale, elle doit prendre les mesures nécessaires pour traiter et régler les factures électroniques. L'obligation concerne les transactions nationales B2B, émises en vertu de la loi belge sur la TVA. Les transactions transfrontalières ne sont pas concernées.

À la lumière de l'obligation, le gouvernement modifie également la définition des factures électroniques. La nouvelle définition met l'accent sur les factures électroniques structurées, les distinguant des simples PDF envoyés par e-mail. L'accent est mis sur le traitement automatique et électronique, en accord avec le concept de communication "machine à machine".

Cadre de facturation électronique

Pour faciliter cette transition, le gouvernement a introduit l'utilisation du réseau Peppol. Se connecter via Peppol offre des avantages d'interopérabilité, éliminant le besoin d'accords bilatéraux entre les participants et fournissant une norme commune pour tous. Le réseau est déjà opérationnel dans le pays en tant que méthode de livraison principale pour les obligations de facturation électronique de l'entreprise vers le gouvernement (B2G).

Afin de répondre aux besoins les plus spécifiques des entreprises, le gouvernement a mis en place ce qu'on appelle l'approche "Double piste", où la première piste - réseau et format par défaut, sera basée sur Peppol.

La deuxième "voie" permettra aux contribuables de se retirer du réseau par défaut, sur la base d'un accord mutuel, et d'utiliser un autre moyen pour la facturation électronique, c'est-à-dire l'EDI.

Incitations gouvernementales et déductions fiscales disponibles

Le gouvernement belge comprend les défis posés par la transition obligatoire. Pour inciter les entreprises, le gouvernement a introduit une initiative fiscale qui permettra aux entreprises de réclamer des impôts sur certaines mises en œuvre de la facturation électronique, abonnements et frais de consultation.

Jetez un œil à l'initiative complète ici

Commencez votre parcours de facturation électronique avec Banqup Group

Mettre en place des procédures de facturation électronique efficaces et conformes peut être une tâche exigeante. Au sein du Groupe Banqup, nous prenons en charge les tâches exigeantes pour que vous n'ayez pas à le faire. Des entreprises du monde entier utilisent nos services afin de créer des processus conformes aux cadres réglementaires locaux. Forts de notre expérience étendue auprès de nombreuses entreprises belges, nous avons une compréhension approfondie des processus locaux et des besoins en prévision des prochaines réglementations.

Pour vous assurer que vous avez les bons processus en place, contactez un membre de notre équipe locale en Belgique pour discuter de vos besoins en matière de facturation électronique.