Slovenië maakt vooruitgang richting verplichte e-facturatie en e-rapportage

Laatst bijgewerkt op 30 oktober 2025, om de definitieve goedkeuring van de wet op e-facturering weer te geven, die de verplichting uitstelt tot januari 2028 en de e-rapportageplicht verwijdert.

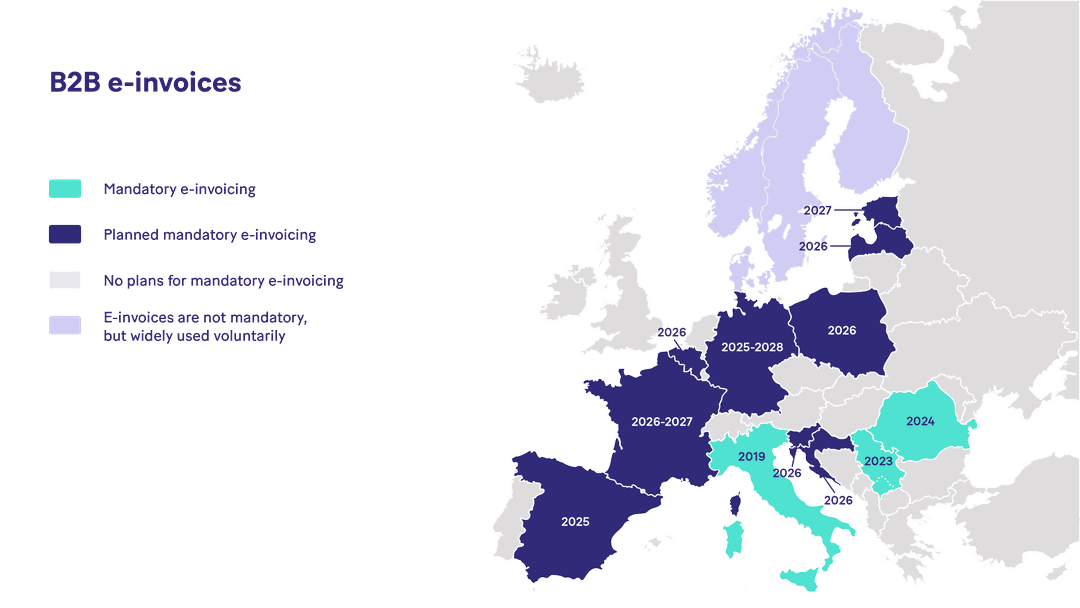

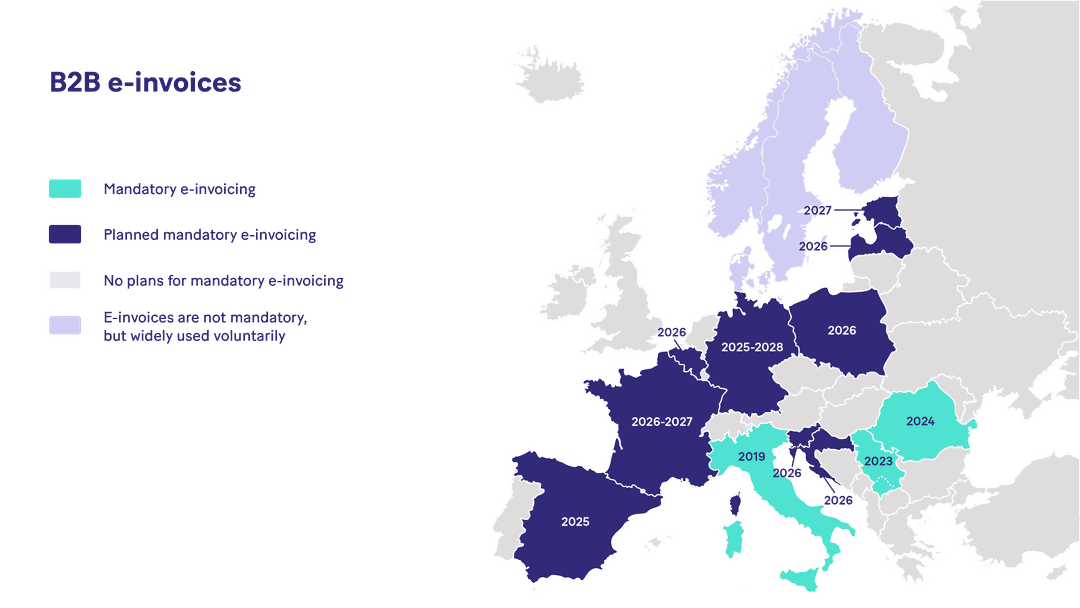

Slovenië richt zich op verplichte e-facturering tegen 2028, in lijn met een groeiende trend in Europa op het gebied van digitale belastingen, terwijl de vereiste voor e-rapportage definitief wordt geschrapt.

Eind juli 2024 zette Slovenië de eerste stappen richting de invoering van verplichte elektronische facturering en elektronische rapportage voor bedrijven in hun commerciële activiteiten door een voorstel in te dienen voor de verplichting tot e-facturering en e-rapportage. Na analyse van de resultaten en verplichtingen in andere Europese landen, waaronder Italië, Roemenië, Polen en België, koos Slovenië voor het Decentralised Continuous Control and Exchange Model (DCTCE).

Het oorspronkelijke wetgevende kader, zoals uiteengezet in het Conceptwet op de uitwisseling van elektronische facturen en andere elektronische documenten (ZIERDED), gepubliceerd door het Ministerie van Financiën op 11 februari 2025, stelde de initiële doelstelling op 1 januari 2027. Dit was een uitstel ten opzichte van eerdere voorstellen van april en juli 2026, en de wet had al het idee van verplichte realtime rapportage losgelaten.

Dit is echter vervangen: op 23 oktober 2025 heeft de Sloveense Nationale Vergadering officieel de nieuwe Wet op de uitwisseling van elektronische facturen en andere elektronische documenten aangenomen. Dit legt 1 januari 2028 vast als de definitieve invoeringsdatum voor de B2B e-factureringsplicht, een verdere uitstel ten opzichte van de eerder voorgestelde datum van januari 2027, terwijl de verplichting tot e-rapportage definitief wordt verwijderd.

Vorm en details van het voorstel

Verplichte e-facturering bij binnenlandse B2B-transacties

Vanaf 1 januari 2028 wordt elektronische facturering verplicht voor alle business-to-business transacties in Slovenië. Deze verplichting geldt voor alle bedrijven die zijn geregistreerd in het Sloveense handelsregister, evenals voor individuen die commerciële activiteiten uitvoeren. Papieren facturen worden niet langer geaccepteerd voor B2B-transacties.

E-facturen moeten gestructureerde XML-documenten zijn die de automatisering van bedrijfsprocessen mogelijk maken; PDF-bestanden kwalificeren niet als e-facturen. E-facturen worden uitgewisseld via gedecentraliseerde beveiligde kanalen met één van de volgende methoden:

In het lokale eSLOG-formaat;

In een syntaxis in lijn met de Europese Norm 16931;

Of in een andere standaard, mits dit contractueel is overeengekomen tussen de handelspartijen.

Als de verzender en ontvanger verschillende e-factuurformaten gebruiken, moet de e-factuur worden geconverteerd door een geregistreerde dienstverlener (“ponudnikov e-poti”, of vrij vertaald: e-route of e-path providers). E-facturen kunnen worden uitgewisseld via dergelijke geregistreerde providers, het Peppol-netwerk, of een directe verbinding tussen de partijen, mits beide partijen hiermee instemmen. Daarnaast biedt de Finančna uprava Republike Slovenije (FURS), de nationale belasting- en douaneautoriteit, een gratis applicatie genaamd miniBlagajna om de uitwisseling van e-facturen voor kleine belastingplichtigen te vergemakkelijken.

Bedrijven die met consumenten werken, kunnen ook e-facturen naar hun particuliere klanten sturen, mits de ontvanger instemt en een leesbare versie van de e-factuur wordt geleverd, bijvoorbeeld in PDF of een ander afbeeldingsformaat. E-mailproviders kunnen alleen worden gebruikt als de ontvanger een consument is.

Verplichte e-rapportage – aanvankelijk gepland, maar uiteindelijk geschrapt

Het Sloveense voorstel omvatte aanvankelijk een bredere scope voor e-rapportage, inclusief grensoverschrijdende transacties voor Sloveense operators (zowel leveranciers als kopers) en B2C-facturen. De definitieve versie van de wetgeving die werd aangenomen, verwijdert echter de verplichting tot e-rapportage. Dit betekent dat het CTC-component uit het systeem is verwijderd. De wet vereist geen rapportage van uitgewisselde e-facturen aan de FURS.

In lijn met het DCTCE-model voorzag het land ook de betrokkenheid van e-factureringsdienstverleners. Bedrijven zouden hun transacties kunnen rapporteren of verzenden via hun eigen software of met hulp van deze dienstverleners, die een accreditatieproces zouden moeten doorlopen om te worden opgenomen in het officiële register van de Sloveense Publieke Betalingsadministratie, UJP (Uprava za javna plačila).

Het schrappen van verplichte realtime e-rapportage vermindert echter niet het belang van voorbereiding op naleving van verplichte e-facturering, die nog steeds van kracht zal worden.

Zorgen voor naleving van e-facturatie

De VAT in the digital age (ViDA) reform, die uiteindelijk op 11 maart 2025 werd goedgekeurd door de EU-financeministers tijdens de ECOFIN-vergadering, laat onvermijdelijk zijn stempel achter op de e-facturerings- en e-rapportagewetgeving in de ondersteunende landen. Vanaf 1 januari 2028 is de verplichte uitwisseling van e-facturen voor alle Sloveense bedrijven een geleidelijke voorbereiding op de wijziging van de richtlijn die de btw in het digitale tijdperk reguleert. Volgens deze richtlijn wordt het uitgeven en uitwisselen van e-facturen voor grensoverschrijdende transacties tussen btw-plichtigen verplicht vanaf 1 juli 2030.

Verplichte e-facturering wordt snel realiteit, niet alleen voor bedrijven in Slovenië, maar wereldwijd.

Om ervoor te zorgen dat uw bedrijf compliant wordt en blijft, is het essentieel om samen te werken met een e-factureringsprovider die compliant is in meerdere landen wereldwijd. Bij Banqup Group zijn we belastingcompliant in meer dan 60 landen, en dit aantal groeit continu.

We werken nauw met u samen om de ideale e-factureringsoplossing voor uw bedrijf te creëren, met toegevoegde waarde die zakelijke transacties nog eenvoudiger maakt.

Ontdek vandaag nog onze compliant e-factureringsoplossing en neem contact op met ons lokale team voor meer informatie. Voor updates over verplichtingen en veranderingen in de sector kunt u ons volgen op LinkedIn.